Inflation forcing Americans to rely on credit cards for daily expenses

09/22/2022 / By Mary Villareal

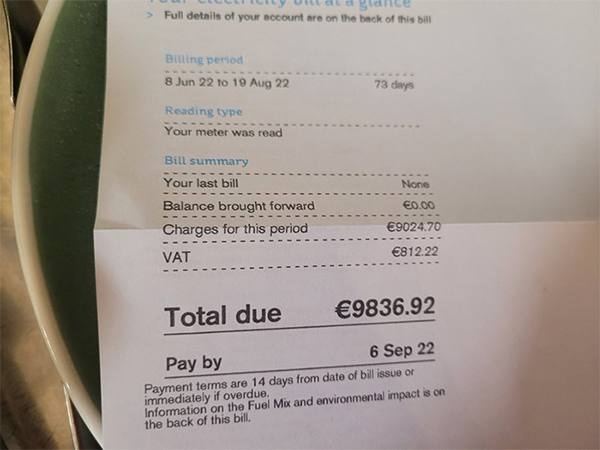

Around 60 percent of Americans are now carrying monthly credit card debt for at least 12 months, according to a survey from CreditCards.com commissioned by survey platform YouGov.

Moreover, 40 percent of those who carry balances say they have been doing so for at least two years, 28 percent for at least three years and 19 percent for at least five years.

It also showed that 59 percent of American credit card holders who are earning less than $50,000 carry a monthly credit card balance.

The percentage decreases to 49 percent for those earning between $50,000 and $80,000 and 46 percent for those earning between $80,000 to $100,000.

Americans hold a total of approximately $887 billion in credit card debt as of June, according to the Federal Reserve Bank of New York.

This is an increase of roughly 13 percent from the same time last year, which is the largest increase seen in 20 years, according to Lightcast senior economist, Ron Hetrick.

Credit card debt is accumulating as its average costs rise. The average interest rate for a new credit card is between 18 and 25 percent, according to online marketing lead generator and mortgage broker, LendingTree.

LendingTree credit analyst Matt Schulz said even people with the best credit scores can expect to pay 18 percent interest rates or higher on their new credit cards. (Related: Chase, JP Morgan credit cards to charge additional “cash advance” fees to people buying Bitcoin.)

Ted Rossman, a senior analyst at CreditCards.com, said credit card debt is easy to get into and hard to get out of, with high inflation and rising interest rates making it harder to break free from the cycle.

Consumer prices for basic necessities are also on the rise, which is increasing the likelihood of more Americans racking up their debts to keep up with the costs.

The Bureau of Labor Statistics also noted that grocery prices rose by 0.7 percent from July to August while prices for food at home rose 13.5 percent from the previous year.

Gasoline prices have dropped by 10.6 percent from July to August, but it is still a staggering 25.6 percent higher compared to the previous year.

Day-to-day expenses reason for racking up credit card bills

Nearly a quarter of respondents from the survey said day-to-day expenses are the primary reason why they carry a credit card balance, and almost half cited an emergency or unexpected expenses, such as medical bills or home or car repair.

The Federal Reserve is also likely to raise interest rates for the fifth time this year. Rates are typically directly tied to the Fed Funds rate, and their increase, along with a softening economy may lead to even higher delinquencies.

Delinquency rates for credit cards – in which a portion of the payment is late by 90 days or more – had been steadily rising.

Wilbert Van Der Klaauw, senior vice president at the New York Fed, previously said their data showed transitions into delinquency among credit card borrowers have risen steadily since 2016, most notably among younger borrowers.

The youngest Americans, usually around 18 to 29 years old, suffer the highest delinquency rates of around 9.36 percent, while older Americans, usually those over 50, have delinquency rates below five percent, which tends to be on track with their increased wealth compared to younger generations.

Total consumer debt already rose by $23.8 billion in July to a record $4.64 trillion, but these numbers include credit card debt, student loans and auto loans. However, it does not factor in mortgage debt. (Related: Inflation causing financial stress on young, low-income Americans.)

Revolving credit was said to have fallen sharply at the onset of the pandemic when business and activity restrictions limited people’s opportunities to spend. However, it has since soared back to record levels as consumers began spending again.

Visit DebtCollapse.com for more news related to credit card debts.

Watch the video below to know more about the exploding credit card debts amidst the ongoing inflation.

This video is from the Zoon Politikon channel on Brighteon.com.

More related stories:

Sources include:

Submit a correction >>

Tagged Under:

bubble, chaos, collapse, credit card, credit card debt, crisis, debt bomb, debt collapse, economic collapse, economy, Federal Reserve, finance, inflation, market crash, money supply, panic, rising costs, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 EconomicRiot.com

All content posted on this site is protected under Free Speech. EconomicRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. EconomicRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.