Couples are now fighting while shopping as grocery prices soar to new highs

09/22/2022 / By Mary Villareal

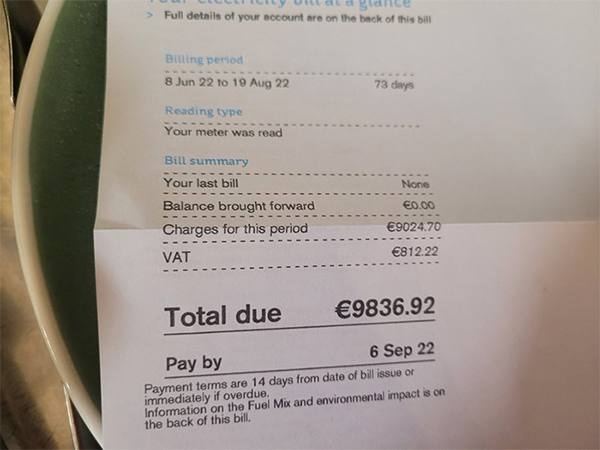

Leibel Sternbach, a financial adviser, shared how his wife now has to double check their fridge after every shopping trip to tell him which things he didn’t need to buy. After all, their weekly grocery costs are now up to $350 per week.

Last year, it was only around $220.

He and his wife have already given up on their favorite snacks – babka for him and KitKat candy bars for his wife.

Arne Boudewyn, head of family wealth and culture services at Wells Fargo, said this scenario is happening in many households across the country. “You don’t want to have these conversations in the grocery store aisle,” he said.

Stores and suppliers clash, too

Before couples fight over their weekly grocery budgets, supermarkets and suppliers already negotiate and sometimes clash over how much products should cost.

This was put on display last summer when Kraft Heinz proposed to hike up their prices by as much as 30 percent in the United Kingdom at a time when people were already struggling to cope with rising costs for housing, energy and more. When British supermarket chain Tesco pushed back, it stopped getting Heinz product shipments such as ketchup and baked beans.

Meanwhile, a pricing dispute in Canada led to grocery chain Loblaw pulling Frito-Lay products from its shelves. Canadian consumers were unable to find Cheetos, Doritos and Lay’s potato chips on the shelves.

In the U.S., retailers and consumer packaged goods companies had been suffering due to higher fuel, materials and labor costs, leading to companies toeing the line of keeping prices high enough to drive profits, but low enough to keep the customers. These issues also fueled discussions as retailers and suppliers negotiated how much of the extra costs should be passed on to customers.

Olivia Tong, an analyst for equity research firm Raymond James, likened the issue to buying a car. “Normally, there’s some bit of negotiation. When it’s any major price move, there’s always going to be a little like, ‘Oh, no, that’s too much.’ And then you finally get to a happy medium where nobody’s happy,” she explained.

Company profits and household budgets had been under pressure due to higher costs, and grocery stores have been hit hard. Food prices have soared by 10.9 percent over the past 12 months as of July, and many items jumped far higher.

The price of eggs, for instance, is up 38 percent, while coffee is up over 20 percent.

Even manufacturers are scrambling to find ways to cut costs or boost their profits in ways people won’t notice as much. For instance, they can load up each truck with more goods or they can shrink package sizes.

Retailers like Walmart and Target are already cutting their profit outlooks for the year, but more concrete numbers will be available soon as they report their quarterly earnings.

Andre Schulten, the chief financial officer of Procter & Gamble, said in July that nobody is happy about the continued inflationary trends. The company also said price hikes aren’t covering all the higher costs across its portfolio.

Not all manufacturers feel that they can maintain their prices. Conagra Brands, for instance, told its retailers that if the company can’t maintain its profit margins, it can’t invest in creating new or upgraded products.

Moreover, price hikes can alienate customers. Around 56 percent of Americans feel that companies are raising prices more than needed to boost profits, as per a late July survey by consulting firm Deloitte.

Visit Collapse.news for more information about inflation and how it is affecting families in the United States.

Watch the video below to hear a commentary about why consumer prices are unexpectedly rising again.

This video is from the Martin Brodel channel on Brighteon.com.

More related stories:

What will you do when inflation forces U.S. households to spend 40 percent of their incomes in food?

Corn and soybean farmer warns Americans that average grocery bill could increase by $1,000 per month.

Sources include:

Submit a correction >>

Tagged Under:

bubble, budget, chaos, collapse, debt collapse, economy, family budget, food collapse, food inflation, food prices, food supply, grocery, hunger, inflation, recession, risk, supply chain

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 EconomicRiot.com

All content posted on this site is protected under Free Speech. EconomicRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. EconomicRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.