China waging “fire sale” of U.S. treasuries, dumping $53 billion in just the first quarter of 2024

05/21/2024 / By Cassie B.

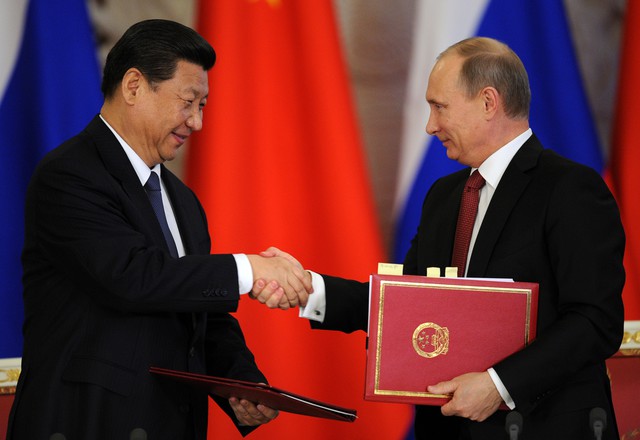

China has made a bold move in its push to diversify away from American assets in the wake of trade tensions by selling off a record amount of Treasury bonds.

Data from the U.S. Department of the Treasury shows that China offloaded more than $53 billion worth of agency bonds and Treasuries during the first quarter, while Belgium – a custodian of Chinese holdings – offloaded $22 billion in Treasuries during the same span of time.

Bloomberg notes that investors are paying close attention to China’s U.S. investments as the tensions between the biggest global economies ramp up. President Biden has announced significant tariff increases on Chinese imports, while Trump has said that he is mulling a levy of upwards of 60 percent on goods from China should he win the election.

Bloomberg Intelligence’s Stephen Chiu noted: “As China is selling both despite the fact that we are closer to a Fed rate-cut cycle, there should be a clear intention of diversifying away from US dollar holdings. China’s selling of US securities could speed up as US-China trade war resumes.”

He added that this could be particularly dramatic if Trump wins the election.

China increasing holdings of gold

China is also raising the percentage of gold in its reserves while selling dollar assets, hitting a 4.9% share last month. This is the highest share seen there in nearly 10 years. Some analysts have speculated that China could hold significantly more gold than officially reported, potentially keeping several thousands of tons of gold in a separate entity that is essentially off the books.

China isn’t the only country that is currently increasing holdings of gold in its official reserves; other nations closely tied to China have been taking similar steps. This is being interpreted by some experts as a reaction to the risk of sanctions as geopolitical tensions with the U.S. rise. The economic impact of the sanctions placed by Western nations on Russia after its invasion of Ukraine in 2022 demonstrated America’s willingness to take this path, and China is seeking to protect itself.

LaDuc Trading Macro Adviser Craig Shapiro said he believes there are several reasons behind China’s diversification attempts. The first is the handling of Russian reserves and related sanction threats. However, he also believes that increasing American fiscal deficits are also playing a role.

“China probably anticipates that U.S. interest rates will continue to rise due to persistent fiscal deficits, making it prudent to sell now rather than risk losses or repayment in devalued dollars,” he said, adding that selling its holdings could protect its domestic economy without worrying about the potential devaluation of the yuan.

China and other BRICS nations have been pushing hard for dedollarization, taking steps to reduce their dependence on the dollar to manage financial risk. After all, U.S. sanctions are only effective if there is widespread use of the dollar, especially among the countries targeted by the sanctions.

Bridgewater Associates CEO Ray Dalio said in a recent interview: “The United States’ greatest weapon to use – as distinct from its military – is sanctions, so sanctions means you freeze other assets, and those assets are (US Treasury) bonds. That happened with Russia and there are threats of it with other countries. There is the thinking that if I hold the bonds can that happen to me? Why am I transacting in this third currency rather than transacting directly?”

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, bonds, BRICS, bubble, chaos, China, conspiracy, currency clash, currency crash, currency reset, dedollarization, dollar demise, economic riot, finance riot, gold, market crash, money supply, risk, sanctions, trade war, treasuries, World War III

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 EconomicRiot.com

All content posted on this site is protected under Free Speech. EconomicRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. EconomicRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.