Massive government spending is keeping inflation high, warns market expert

09/05/2023 / By Arsenio Toledo

The government is not getting its massive spending under control, and this could undermine the Federal Reserve’s ongoing fight against inflation.

Market expert Larry McDonald warned that America’s fiscal situation will get worse without any change. “No one is calling them out,” he said. “Washington is stepping on the gas – colossal deficit spending – and the brakes – with epic rate hikes – at the same time.” (Related: DEBT BLOWOUT: US debt has soared $1.2T since debt ceiling suspension – and the Treasury expects to add another $1.5T by year’s end.)

Despite the Fed’s interventions raising borrowing costs from near-zero to over five percent over the span of less than two years, inflation is still well above the central bank’s target rate of two percent. McDonald blamed the still-high inflation rate on unrelenting government spending levels.

White House has no plans to rein in spending despite possibility of government shutdown

Instead of reining in spending, the White House is now asking Congress to hammer out a short-term funding measure to avoid a partial federal government shutdown on Oct. 1, when the next fiscal year begins, as longer-term spending negotiations continue.

“Although the crucial work continues to reach a bipartisan, bicameral agreement on fiscal year 2024 appropriations bills, it is clear that a short-term continuing resolution (CR) will be needed next month,” claimed a spokesperson for the Office of Management and Budget (OMB) in a statement. “OMB is providing Congress with technical assistance needed to avoid severe disruptions to government services in the first quarter of the fiscal year.”

“We urge Congress to include these anomalies along with the critical emergency supplemental needs the administration transmitted earlier this month in any forthcoming CR, as they have done on a bipartisan basis many times in the past,” continued the spokesperson.

Many government programs are set to run out of funding by Sept. 30. If no action is taken before the next fiscal year on the next day, many of these government functions will immediately shut down.

With less than a month to go before the start of the next fiscal year, the Republican-led House of Representatives and the Democrat-led Senate seem to have only come to an agreement on one of 12 long-term spending and tax measures to keep the government afloat.

Senate Majority Leader Chuck Schumer claimed that he and House Speaker Kevin McCarthy have at least agreed on a stopgap measure.

“I think we’re going to end up with a short-term congressional resolution, probably into December as we struggle to figure out exactly what the government’s spending level is going to be,” said Senate Minority Leader Mitch McConnell during a meeting with business leaders in Kentucky.

But before all House Republicans can get united behind a stopgap funding measure, the House Freedom Caucus is making certain demands, including cutting spending to the 2022 fiscal level of $1.47 trillion, or $200 billion less than what President Joe Biden and McCarthy initially agreed to.

House Freedom Caucus members are also opposing a “blank check” on future aid packages for Ukraine. The caucus has also vowed to vote down any spending measure that does not include the House Republican border security bill, which would expand the wall at the southern border and add restrictions for those seeking asylum in the United States.

Both McConnell and McCarthy recognize that this stopgap measure will allow Republicans to continue their inquiries into the corruption of Biden’s administration as well as allow the party to continue negotiating with Democrats to lower spending and possibly cut back on the deficit.

“I would actually like to have a short-term CR, only to make our arguments stronger, because … if we shut down, all the government shuts it down, investigation and everything else. It hurts the American public,” said McCarthy, who noted that House Republicans may begin a potential impeachment inquiry into Biden.

Learn more about government spending plans at WhiteHouse.news.

Watch this clip from Fox News featuring economist Steve Moore warning that the U.S. still has to deal with higher-than-normal inflation.

This video is from the News Clips channel on Brighteon.com.

More related stories:

Taxpayer money going down the drain: Biden circumvents SC decision, cancels $72M in student debt.

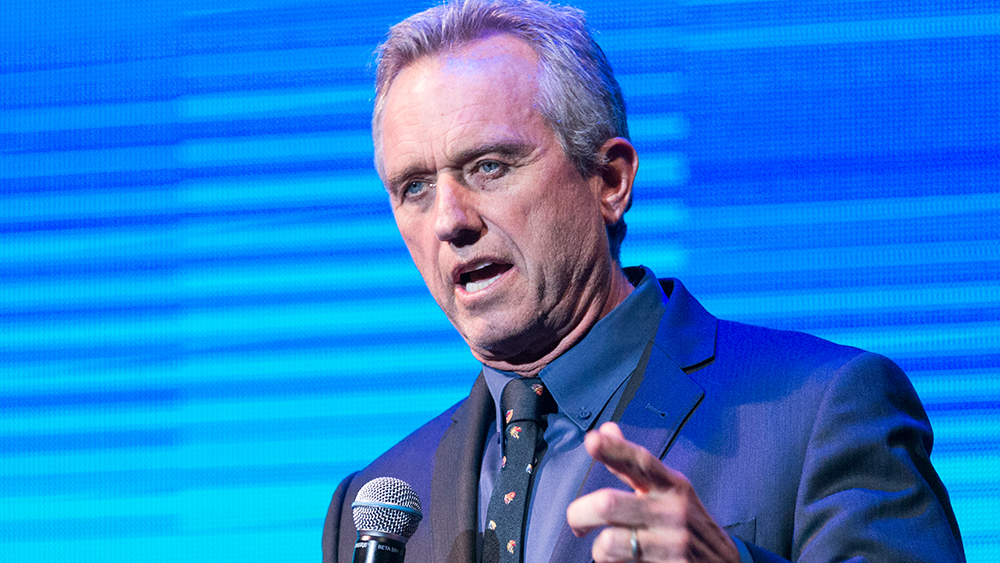

RFK Jr. blasts U.S. government for its “addiction to war” following $24B aid request for Ukraine.

American families are spending $709 a month more than two years ago due to Biden’s inflation.

Sources include:

Submit a correction >>

Tagged Under:

big government, bubble, debt bomb, debt collapse, economic collapse, economic riot, economy, Federal Reserve, finance, finance riot, financial crash, government debt, government spending, inflation, inflation crisis, Larry McDonald, market crash, money supply, national debt, risk, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 EconomicRiot.com

All content posted on this site is protected under Free Speech. EconomicRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. EconomicRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.