Unstable U.S. Treasury market experiences its worst day in the last six months

11/14/2023 / By Belle Carter

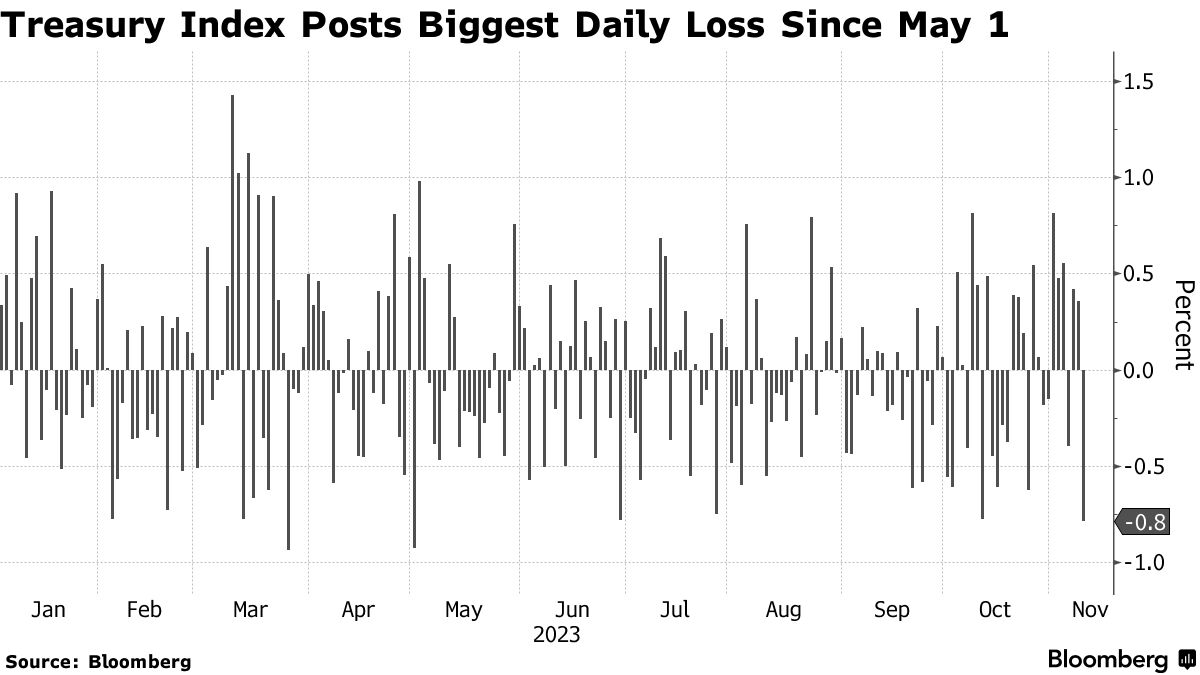

The U.S. Treasury market has been awfully shaky for quite a while but it had its worst day in six months on Thursday, November 9, as measured by the performance of the Bloomberg Treasury Index. A disastrous auction of 30-year Treasury bonds sent long-maturity yields soaring as investors demanded additional compensation for funding a ballooning fiscal deficit.

On the same day, Federal Reserve Chairman Jerome Powell told reporters at the International Monetary Fund conference in Washington that another interest-rate hike aimed at curbing inflation is still possible, unleashing a surge in short-term yields.

Everyone has already been noticing the sharp rise in yields in recent months. In early October, the U.S. 10-year hit the highest yield level in 16 years, which is about five percent. Because of this, rate hikes by the Fed have pushed bond yields higher. “But what we have been seeing is more than a manifestation of the vicissitudes of finicky markets,” RT reported. “As foreign buyers of U.S. Treasuries dry up and the U.S. government continues to run astronomical deficits at a time of high interest rates, the Treasury market is coming under increasing strain and showing ever more signs of dysfunction. The implications of this are hard to overstate.”

“It’s still too early to call the all-clear on rates and inflation,” claimed Alberto Gallo, chief investment officer and co-founder of Andromeda Capital Management. “The Fed might be done hiking, but that doesn’t mean a lot of cuts are coming soon,” as interest-rate futures markets continue to anticipate.

Powell and other Fed policymakers have repeatedly maintained that rising bond yields, by tightening financial conditions, can avert the need for additional interest-rate hikes. From that standpoint, declining yields quickly run into trouble. The Fed had also claimed in the past that the nastiest bout of inflation in four decades had forced it to sharply hike rates. But the higher interest rates pushed bond yields up, and since bond prices move inversely with yields, U.S. Treasuries took losses, the news outlet wrote.

“Many U.S. banks became deeply underwater on their Treasury positions, a fact that played no small role in the collapse of Silicon Valley Bank earlier this year,” it stated, adding that there were specific reasons why that particular bank collapsed, including non-existent risk management. But the incident actually revealed many banks were sitting on large unrealized losses in their Treasury positions.

Depositors feared bank failures and to place their money in higher-yielding money market funds, demanded their money back. Banks would also have had to sell their underwater Treasuries into a rapidly deteriorating market, where bids would have been few. However, undoubtedly sensing the fragility of the entire system and not wanting a full-blown meltdown on their watch, Powell decided to act decisively.

Biden administration is squandering money as if there is no tomorrow

The current fiscal year’s deficit is expected to hit or possibly go over $2 trillion. It represents 8.5 percent of gross domestic product (GDP). Unsurprisingly, Treasury issuance is slated to go through the roof in the coming quarters. In addition to the separate question of how the U.S. can afford the suddenly massively higher interest payments on this debt, there is the issue of the acute lack of marginal buyers of this debt. The federal debt is estimated to reach $1 trillion on an annualized basis this year. RT Editor Henry Johnston commented that the Fed is engaged in quantitative tightening. This means that it is allowing bonds to mature and run off its balance sheet rather than roll them over. (Related: Annual interest on U.S. debt soars past $1 trillion for the first time in history.)

“Commercial banks nationwide have little capacity or appetite for more Treasury purchases. They are trying to take duration off their balance sheets and have been reducing Treasury holdings,” Johnston said citing JPMorgan CEO Jamie Dimon, who just recently warned that rates could go higher still. “So he’s not looking to plough into Treasuries,” he said. Of course, President Joe Biden’s administration, even those who sat in the White House prior to him, steadfastly refused to believe it had a fiscal problem. To be fair, in the low-interest rate era and with foreign demand for U.S. debt ever present, perhaps it did not. “The U.S. was perhaps a debt addict, but a functional one,” the editor added. However, he said running huge deficits in a time of rising interest rates is a combustible mix.

“The current highly financialized, deeply indebted U.S. economy is a shadow of its former self, but policymakers don’t seem to have adjusted,” he opined. “Some form of outright yield curve control is coming and probably sooner rather than later. It is already creeping into the realm of mainstream speculation. But this time it will hardly resemble a temporary war-time policy; rather it will be a move of desperation far down the road toward outright dysfunction of a market at the very heart of the global financial system.”

He warned that a breakdown in the functioning of the Treasury market will trigger the widespread realization that America has turned itself into something akin to the terrorist-rigged bus set to explode if it slows to below 50 mph in the 1994 Keanu Reeves film “Speed.” It will be politically unable to backtrack on its entitlements and military commitments but unable to afford them. It will also run into the fiscal wall of excessive interest expenses and insufficient demand for its debt, he said. He added that the Fed has become uncannily adept at patching up markets as it is employing its standard technique of “extend and pretend… then inflate.” “The rot at the very heart of the global financial system is becoming increasingly apparent for those with the eyes to see it,” he concluded.

Bookmark EconomicRiot.com to get updates on the collapsing U.S. economy.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, Bloomberg Treasury Index, bubble, central banks, collapse, debt bomb, debt collapse, deficit, economic collapse, economic riot, economy, Federal Reserve, finance riot, financial system, GDP, global financial system, government debt, government spending, inflation, interest rate, market crash, money supply, national debt, risk, Treasury holdings, US Treasury

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 EconomicRiot.com

All content posted on this site is protected under Free Speech. EconomicRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. EconomicRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.